Mastering Forex Trading with MetaTrader 4

Forex trading is becoming increasingly popular among investors and traders across the globe. With numerous platforms available, MetaTrader 4 (MT4) stands out as one of the most widely used and trusted platforms in the Forex market. In this article, we will explore the fundamentals of Forex trading with MT4, discuss its key features, and provide tips for maximizing your trading success. For more detailed insights into trading, feel free to visit forex trading with mt4 trading-bd.com.

What is Forex Trading?

Forex trading, or foreign exchange trading, involves the buying and selling of currencies in an effort to profit from fluctuations in their exchange rates. It is a decentralized global market where currencies are traded 24 hours a day, five days a week. With a daily trading volume exceeding $6 trillion, Forex is the largest financial market in the world.

Introduction to MetaTrader 4

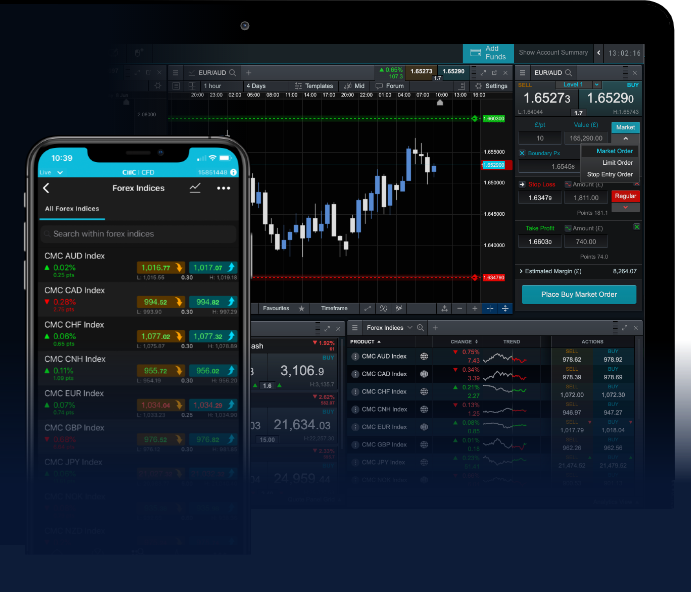

MetaTrader 4 is a software platform designed for online trading in the Forex, CFD, and futures markets. Developed by MetaQuotes Software Corp. in 2005, MT4 provides traders with a user-friendly interface, advanced charting tools, and a range of functionalities that make it a popular choice for both novice and experienced Forex traders.

Key Features of MetaTrader 4

User-Friendly Interface

The platform is designed with traders in mind, featuring an intuitive interface that makes navigation easy. This is particularly advantageous for beginners who may feel overwhelmed by the complexity of trading.

Advanced Charting and Technical Analysis

MT4 offers a wide array of charting tools and technical indicators that enable traders to analyze market trends effectively. With multiple timeframe options and the ability to customize charts, traders can perform detailed analysis to inform their trading decisions.

Automated Trading with Expert Advisors (EAs)

One of the standout features of MT4 is the ability to use Expert Advisors (EAs), which are automated trading systems that execute trades based on pre-defined trading strategies. This functionality allows traders to take emotion out of trading and to capitalize on market opportunities 24/7.

Support for Multiple Order Types

MT4 supports various order types, including market orders, pending orders, stop-loss orders, and take-profit orders. This flexibility allows traders to manage their positions effectively and tailor their strategies to their individual trading styles.

Mobile Trading Capability

With the rise of mobile devices, MT4 also offers mobile applications that allow traders to monitor their accounts and execute trades on the go. Whether you are commuting or traveling, you can stay connected to the markets.

Getting Started with MetaTrader 4

1. Download and Install MT4

To start trading on MT4, first, you need to download and install the platform from your chosen broker. Most brokers provide an easy-to-navigate setup guide, allowing you to get started quickly.

2. Create a Demo Account

Before risking real money, it is advisable to open a demo account. This allows you to practice trading in a risk-free environment using virtual funds, helping you familiarize yourself with the platform and refine your trading strategies.

3. Fund Your Live Account

Once you feel confident with your demo trading, you can open a live account and deposit real funds. Be sure to choose a broker that aligns with your trading goals and offers competitive spreads and commissions.

Developing a Trading Strategy

Having a well-defined trading strategy is crucial for success in Forex trading. Here are some steps to help you develop a solid strategy:

1. Define Your Goals

Determine your financial goals and risk tolerance. This will help you tailor your trading approach to fit your personal objectives.

2. Perform Market Analysis

Engage in both fundamental and technical analysis to assess market conditions. Keep abreast of economic news and events that may affect currency movements.

3. Choose a Trading Style

Decide whether you want to be a day trader, swing trader, or long-term investor. Each style has its own methodologies and risk profiles.

4. Set Risk Management Rules

Establish rules for risk management, including position sizing, stop-loss placements, and target profits. Stick to these rules to minimize losses and protect your trading capital.

Common Mistakes in Forex Trading

Many traders fall victim to common mistakes. Being aware of these pitfalls can help you avoid them:

1. Lack of Education

Trading without adequate knowledge is a recipe for disaster. Invest time in learning about the Forex market and how to trade effectively.

2. Emotional Trading

Allowing emotions to dictate your trading decisions can lead to irrational behavior. Stick to your trading plan and avoid chasing losses.

3. Ignoring Risk Management

Failing to implement a robust risk management strategy can wipe out your trading account quickly. Always prioritize safeguarding your capital.

Conclusion

Forex trading with MetaTrader 4 offers numerous opportunities for traders of all skill levels. By understanding the platform’s features, developing a solid trading strategy, and avoiding common mistakes, you can position yourself for success in the Forex market. As you embark on your trading journey, remember to stay disciplined, continuously educate yourself, and keep refining your strategies to adapt to the ever-changing market conditions.