Forex Trading for Dummies: A Beginner’s Guide

Welcome to the exciting world of Forex trading! If you’re looking to dive into the Forex market and start trading currencies, you’re in the right place. In this guide, we will walk you through the essentials of Forex trading, breaking down complex concepts into easily understandable terms. Whether you’re a novice or someone with just a curious mind, this article will provide you with essential knowledge. To find out more about reputable trading platforms, check out the forex trading for dummies Best Uzbek Brokers.

What is Forex Trading?

Forex, short for foreign exchange, is the global marketplace for buying and selling national currencies against one another. The Forex market is the largest financial market in the world, operating 24 hours a day, five days a week. Unlike stock trading, where stocks are bought and sold from exchanges, Forex trades occur over-the-counter (OTC), meaning that transactions are done directly between parties, typically through electronic networks.

How Forex Trading Works

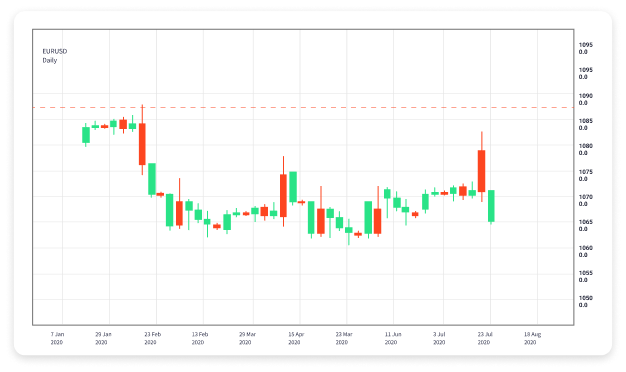

In Forex trading, currencies are always quoted in pairs. For example, the Euro/US Dollar (EUR/USD) is a currency pair that shows how many US dollars (USD) are needed to purchase one Euro (EUR). If the EUR/USD is priced at 1.20, it means 1 Euro is equal to 1.20 USD. Traders speculate on the movement of these currency pairs to profit from changes in exchange rates.

Key Terminology in Forex Trading

To gain a solid understanding of Forex trading, it’s important to familiarize yourself with some key terms:

- Pip: A pip is the smallest price move that a given exchange rate can make based on market convention. For most currency pairs, it is equal to 0.0001.

- Leverage: Forex leverage allows traders to control larger positions with relatively small amounts of capital. It can magnify gains but also increases the risk of losses.

- Spread: The spread is the difference between the bid price and the ask price. It is a cost incurred when trading currencies.

- Margin: This is the amount of money required to open a position or maintain it. Margin is a percentage of the full value of the trade.

- Lot: A lot is the term used to describe the size of a trade. In Forex, the standard lot size is 100,000 units of the base currency.

Types of Analysis in Forex Trading

To make informed trading decisions, Forex traders commonly use three types of analysis: fundamental, technical, and sentiment analysis.

- Fundamental Analysis: This approach involves analyzing economic news, events, and indicators that can affect currency prices. Factors such as interest rates, inflation, and political events play a crucial role.

- Technical Analysis: Traders who use technical analysis rely on historical price data and chart patterns to predict future price movements. Tools like indicators and trend lines are commonly used in technical analysis.

- Sentiment Analysis: This type of analysis examines the overall mood of the market participants. Understanding trader sentiment can provide insight into potential price movements.

Developing a Trading Strategy

Having a well-defined trading strategy is crucial for success in Forex trading. Your strategy should include your trading goals, risk management rules, and the criteria for entering and exiting trades. Here are some components to consider while developing your strategy:

- Set Clear Goals: Define what you want to achieve with your trading. Are you looking for short-term gains or long-term investments?

- Risk Management: Decide how much of your capital you are willing to risk on each trade. A common rule is to risk no more than 1-2% of your account balance on a single trade.

- Entry and Exit Points: Determine your criteria for entering and exiting trades. This may be based on price levels, patterns, or indicators.

- Keep a Trading Journal: Document your trades, strategies, and thoughts. This can help you understand what works and what needs improvement.

Choosing a Forex Broker

Selecting the right Forex broker can make a significant difference in your trading experience. Here are some factors to consider:

- Regulation: Ensure that the broker is regulated by a reputable authority. This adds a layer of security for your funds.

- Trading Platforms: Evaluate the trading platforms offered by the broker. Look for user-friendly platforms with adequate charting tools and features.

- Fees and Spreads: Understand the fee structure. Different brokers charge different spreads and commissions, which can impact your profitability.

- Customer Support: Reliable customer service is essential for addressing any issues or questions you may have while trading.

Demo Trading: Practice Before You Start

Before you commit real money, it’s important to practice trading on a demo account. A demo account allows you to trade with virtual money and experience the trading platform without risk. This is a valuable opportunity to test your trading strategies, understand how the market operates, and build your confidence before moving to a live account.

Conclusion

Forex trading can be an exciting venture offering the potential for financial success if approached with the right knowledge and discipline. By understanding the basics of Forex trading, familiarizing yourself with key terminologies, developing a solid trading strategy, and practicing with a demo account, you’re setting the foundation for a successful trading journey. Remember to stay patient, keep learning, and continuously seek to improve your trading skills. Happy trading!